I only have windshield damage I need roadside assistance help My car was damaged Something happened to my property

I need help with my car I need to get reimbursed I've been in an accident and need a tow I need roadside assistance information

If you're in an accident, the first step is to file an auto claim. We're here to help.

While speaking with the claims adjuster, please request assistance in moving your vehicle.

A deductible is what's subtracted from your claim's total payment amount. For example, if you have a $1,000 deductible and $2,500 in covered damage to your home and belongings, you'd pay the first $1,000. We'll cover the rest.

*This is an example of a deductible payment.

Log on to view your policy details.

Regardless, you should always notify USAA if your home is damaged.

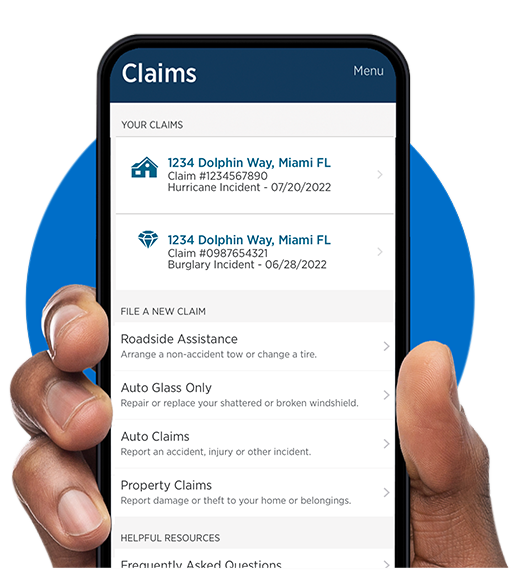

You may have questions after you file your claim, and we're here to help. We've made it easy to message an adjuster, submit additional documentation or receive status updates about things like additional repair costs and recoverable depreciation payments. It can all be done online 24/7 using our claims center.

For answers to commonly asked property claims questions, read video transcript.

Get an in-depth look at common homeowners claims topics.

Video Duration: 2 minutes 33 seconds

Transcript Date: September 29, 2021

Even though your claim has been processed, USAA will be with you until your repairs are completed.

If you have any new information or need to send us anything, we're here to help. You can still submit documentation and communicate with your adjuster. Just use the email address associated with your claim or the Claims Communication Center on usaa.com and the USAA Mobile App.

You may have some questions about your claim, so here are answers to some of the common ones we get from members.

Why is my mortgage company listed on my check?

The mortgage company requires their name to be listed on claim payments issued by USAA. The check must be given to them to endorse before submitting it to your bank for payment. Checks that aren't properly endorsed will be returned without payment.

Please contact your mortgage company for endorsement instructions.

If your mortgage company requests an adjuster worksheet or report, give them your repair estimate.

What if the repairs are going to cost more than the estimate and I have a supplement?

If the repairs are going to cost more than the estimate and you would like a review of the additional supplement for payment, you can use the Claims Communication Center to submit an itemized estimate with documents and photos showing the need for an increase. Keep in mind, your policy doesn't cover the added cost of improvements or upgraded items.

What's recoverable depreciation or “holdback,” and why is it being applied to my loss?

Most insurance companies typically make two payments for a covered loss. The first payment is for the depreciated value of the covered damage at the time of your loss.

A second payment is sometimes made once all the covered damages are repaired. This additional payment is often referred to as recoverable depreciation or “holdback.”

So, if there's damage to your 10-year-old roof, the first payment may reflect the value of a roof that's 10 years old. Once the roof is replaced, you may be reimbursed for the remaining cost of a new roof of similar kind and quality.

How is payment issued for recoverable depreciation?

Send us copies of your receipts or final invoices for the repair or replacement of the damaged property through the Claims Communication Center on usaa.com or the USAA Mobile App. You can also use the email address associated with your claim. Your adjuster will review the material to see if you qualify for a payment for recoverable depreciation.

Keep in mind, any additional payments issued from USAA will account for prior payments and your deductible.

We're here to help you with your claim. Thank you for trusting USAA.