Say "goodbye" to cheques and delays. Get your paycheques on time, every time.

Get same-day access to your money and pay your bills with ease.

We've got your back with encryption technology and our security guarantee. Plus, there's no risk of lost or stolen cheques.

A recurring direct deposit is when money is automatically deposited into your account at regular intervals.

Examples of direct deposits:

Select the account you want to deposit your money into.

On your Account Details page, select “Manage My Account” and select the “Void cheque/direct deposit info” link from the dropdown menu. This will open your prefilled Account Information form.

Print or save your Account Information form, add your signature and the date and give it to your employer or provider.

Sign on to the CIBC Mobile Banking® App.

Select the account you want to deposit your money into.

Select “Account Info” to get your institution number, transit number and account number.

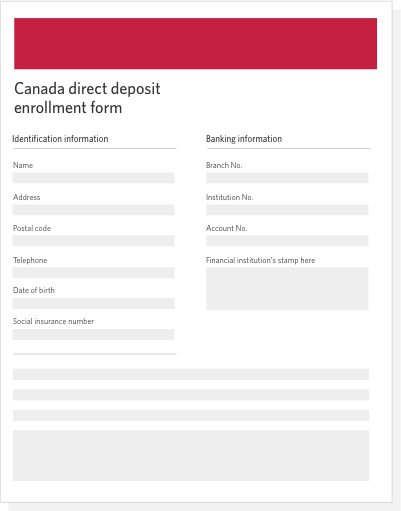

To give this information to your employer or provider, you may need to download and fill out the Payroll, Direct Deposit, or Pre-Authorized Payment Form (PDF, 180 KB) Opens in a new window. .

You can get your pension cheques, tax returns and more directly deposited into your CIBC account.

They're the quick, easy and secure way to get paid on time, every time.

popupresult Terms and conditions1 Eligible recurring transactions: Most recurring direct deposits and pre-authorized debits are eligible. Examples of common recurring direct deposits are payroll, CPP/QPP, disability payments, dividends, and government deposits such as Employment Insurance and provincial parental insurance plan (PPIP). Examples of common recurring pre-authorized debits are pre-authorized bill payments and loan or mortgage payments where you set up pre-authorized instructions with your mortgage, loan, credit card and/or other provider directly from your CIBC Smart Account. Recurring pre-authorized fund transfers that you initiate (i.e., if you use telephone banking, ATM and/or online banking to set up) to other CIBC deposit, credit card or line of credit accounts, or to accounts at other financial institutions, are not eligible for the fee waiver. For further details, consult with your advisor or telephone banking representative to determine whether any given pre-authorized debits or direct deposits are eligible for the fee waiver.